About

the EMB

The network powering Canada’s emerging portfolio managers.

Promote.

Support.

Connect.

The EMB is a non-profit organization founded in 2014 to support the growth of Canada’s start-up and small portfolio management firms.

We aim to convince Canadian institutional asset allocators to invest 1% of their AUM in portfolio management firms owned by entrepreneurs by 2025.

Our mission

To contribute to the growth of Canadian emerging managers by educating asset allocators about the many benefits of investing with local talent.

Our vision

To make the Canadian financial industry conducive to the creation of new portfolio management firms by helping emerging managers meet the requirements of institutional investors.

Our Board of Directors

Committed to promoting our members and propelling the Canadian portfolio management industry

Charles Lemay

Walter GAM

President of the EMB

Mathieu Cardinal

Morningstar

Gabriel Cefaloni

Nymbus Capital

Secretary of the EMB

Minh Nguyen

Kingwest & Company

Ken Koby

Galliant Advisors

Treasurer of the EMB

Philippe Pratte

Pratte Gestion de portefeuilles

Violaine Trudeau

EMB Manager and Coordinator

Jeffrey Veilleux

Rivemont

Philippe Hynes

Tonus Capital

Mathieu Bouthillier

B-CAP

Brennan Basnicki

Auspice Capital

Karine Balé

Innocap (Non-voting external member)

EMB’s four mandates

Events and

networking

Plan training and networking activities that allow emerging managers and asset allocators to meet, and that showcase the talent of its members.

Education and mentoring

Help emerging managers align their practices with the requirements of institutional investors and develop an optimal infrastructure for their business development.

Sponsorships and partnerships

Develop partnerships with sponsors and other private and public organizations to ensure the EMB’s financial viability and to contribute to the achievement of its mission and objectives.

ESG, diversity and inclusion

Make emerging managers more aware of sustainable investment issues and encourage them to integrate diversity and inclusion best practices within their firms.

Emerging manager definition

The EMB defines emerging managers according to the following criteria:

- Headquartered in Canada

- Majority employee-owned

- Less than $1 billion in assets under management ($3 billion for fixed income firms)

- Registered with Canadian regulatory authorities

- Geared to developing strategies adapted to institutional investors

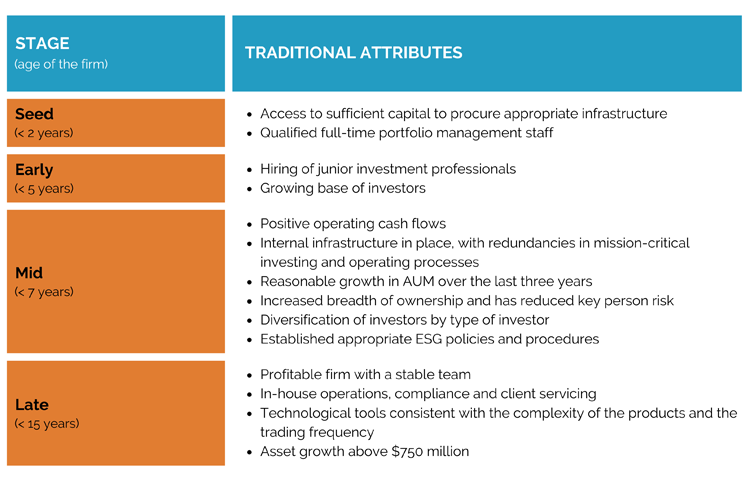

The four stages of an emerging firm’s life cycle

The cycle below is modelled on the New York State Comptroller’s Office Emerging Managers Program.

A key ally and partner

The EMB is proud to have an active partnership with the Quebec Emerging Manager Program. The QEMP gives significant investment mandates to a number of our members after a rigorous evaluation process. This one-of-a-kind program offers institutions investment strategies that diversify their sources of alpha, while encouraging local firms.

You can easily identify members selected under the QEMP program by the QEMP seal in their profile.

Get involved!

Does our mission speak to you?

Drop us a line if you’re interested. We’ll be in touch.

Violaine Trudeau

EMB Manager and Coordinator

[email protected]

Charles Lemay

EMB President

[email protected]