Emerging Managers

Board

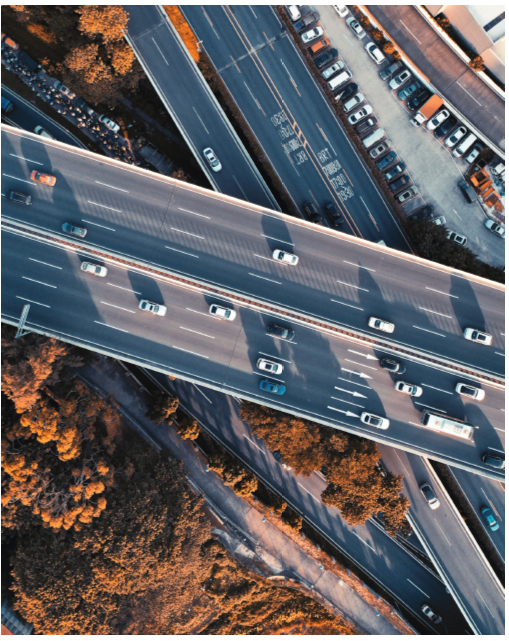

We build bridges between emerging portfolio

managers and asset allocators.

Promote. Support. Connect.

To contribute to the growth of Canadian emerging managers by educating asset allocators about the many benefits of investing with local talent.

Our not-to-be-missed events

Conference & Cocktail Event: The tips and secrets of due diligence processes

For many emerging managers, due diligence processes from pension plans and consultants are a challenge. Understanding the ins and outs of this essential practic [...]

PMAC- Vancouver, BC, Regulatory & Compliance Forum

The Vancouver Regulatory & Compliance Forum will cover a variety of topics that address new developments, critical issues, and insights on how to sustain a [...]

PMAC- Regulatory & Compliance Forum

The Vancouver Regulatory & Compliance Forum will cover a variety of topics that address new developments, critical issues, and insights on how to sustain a [...]

Six good reasons to invest with an emerging manager

Higher alpha potential through active strategies

Lower asset volume for transactional agility

Fees that are more flexible and competitive

Early-stage access to portfolio managers

Better alignment of objectives and interests

Demonstrated success in capital preservation

Find out why they joined our network.

The ranking of our members

Track the potential of emerging managers.

The EMB provides you with its annual ranking of the Top 10 participating emerging managers in three categories: Alternative Management, Traditional Equity Management and Traditional Fixed Income Management.

Our service providers

Experts to put emerging firms on the path to success.

To assist our members with their operational, compliance, marketing and business development needs, we provide a list of specialized securities-industry providers.

Latest news from the EMB

Marketing and asset raising for alternative and emerging managers

Bryan Johnson, founder and managing partner at Johnson & Company, offers a candid, no-nonsense conversation about marketing and raising assets in a must-see video. With more than 25 years of experience in alternative asset classes, having raised $3+ billion over the...

EMB Newsletter

Read our January 2024 Newsletter for the latest news. In this issue: 2024 Elections – Meet the new members of the board of directors 2023 Ranking – Find out who are the winning firms in the three categories A look back at 2023 – A year of many achievements! 2024...

Montreal EMB Holiday Cocktail in photos

Our sponsors